Federal spending plays an essential role in funding thousands of programs in the United States that work to support healthcare, social services, education, and more. These programs are critical to the well-being of citizens, particularly those in underprivileged communities. However, paired with ongoing debates regarding national debt and deficits, decisions on where these funds are allocated and distributed often lead to controversy. A manifestation of these uncertainties occurred on Jan. 27 when President Donald Trump’s Office of Management and Budget sent a memorandum ordering the freeze of federal grants. Although temporarily paused, the possible effects of the funding freeze still influence and showcase the power struggles over federal spending as a whole.

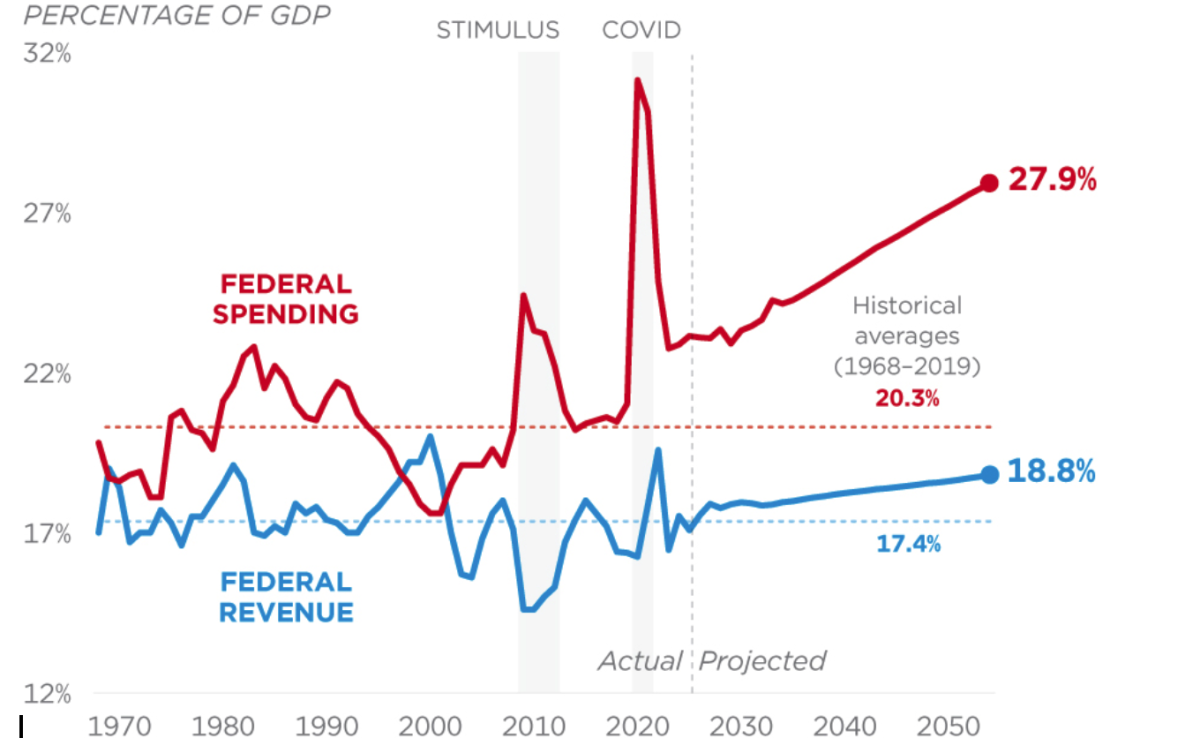

Each year, Congress begins work on the federal budget and decides how to allocate funds. The federal government divides spending into three major categories: mandatory spending, discretionary spending, and net interest. Programs providing benefits to individuals are classified as mandatory spending—Social Security, Medicare, and Medicaid—which account for nearly 75 percent of the expenses. In these programs, people will automatically receive aid if they qualify under specific levels for eligibility. Discretionary spending must be determined by Congress and the president annually through the appropriations process, where it is examined and re-approved each year. Education, defense programs, transportation, environmental protection, law enforcement, and border security are a few spending areas that fall under the umbrella term. Net interest, lastly, focuses on interest payments on the federal debt. Spending on net interest has increased over the past few years, primarily due to the growing national debt, which is currently at $36 trillion, whereas the 2024 nominal United States GDP (gross domestic product) was $29 trillion.

“It’s not necessarily going to be a problem tomorrow, but it might create what we call ‘fiscal pressures’ over time. As your national debt grows, you eventually have to pay it back,” said Matthew Munday, an Upper School history and economics teacher. “As it gets larger, the percent of federal spending toward interest gets bigger and bigger, meaning that as the interest category grows, your capacity to spend on things like mandatory spending and discretionary spending gets smaller.”

Correspondingly, some of the motivation behind Trump’s federal funding freeze can be traced to concerns over the national debt as a means to manage excessive spending and provide the administration time to review agency programs and determine the best usage of funds. Despite rescinding the memorandum only 48 hours after it was issued, questions remain about whether or not the freeze will, in some ways, be put into effect and how that could impact communities and the programs receiving federal aid.

In Georgia, around 32 percent of the budget is made up of money received from the federal government, making it a significant influence on daily life in rural areas and cities alike. Without federal support, the state will need to find new ways to finance programs that impact various areas of life, including education, healthcare, and infrastructure.

“Georgia has had overall a pretty great economy through COVID-19. Pulling this amount of funding is going to indirectly affect the economy on a scale that would be politically problematic,” said Upper School history teacher John Monahan. “It’s probably safe to say that there are thousands of ways that this will affect Georgia.”

Furthermore, specific aspects of life in Atlanta would be impacted if they stopped receiving federal aid. Roads and highways, for example, are built and maintained through funding from federal infrastructure programs such as the Federal Highway Administration, which ensures that advances are being made to improve safety and efficiency. Another example concerns the significant number of small businesses owned in Atlanta and the rest of Georgia. Approximately 99.7 percent of businesses in Georgia are small and receive loans from the Small Business Administration, putting them at risk of closing if the federal freeze advances.

Perhaps the most impacted would be the citizens of Atlanta in disadvantaged areas who rely on federally funded programs for aid.

“I think it could be really harmful to Georgia citizens who benefit from these programs,” said junior Madelyn Wickliffe, a member of the What Just Happened presidential election JanTerm. “They won’t have the same amount of support or resources that they need, which will affect their quality of life.”

Due to the current abundance of federal organizations aimed at supporting schools, education could particularly suffer by a reduction in funding. Title I, for instance, is a program that supplements state and local funding for low-income schools to provide better resources. Other programs ensure free or reduced school lunches for children from financially disadvantaged households. All of these groups are essential for students to have access to a strong education. Food assistance programs like SNAP (Supplemental Nutrition Assistance Program) are also a necessity for a good quality of life.

Even though the Federal Funding Freeze has been paused for the time being, understanding possible outcomes and how it could affect our community is of the utmost importance in determining the next steps forward and contributing to the success of the state.

Edited by Lahiri Nooka